By Daniel - 23/09/2021

By Daniel - 23/09/2021

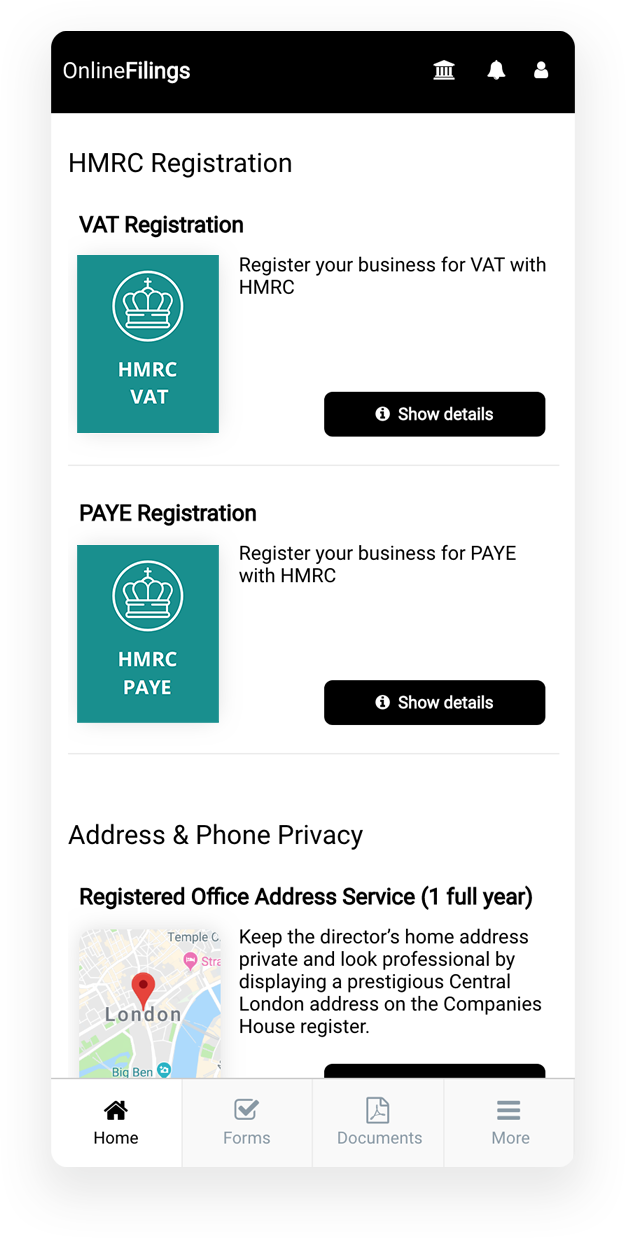

Creating a Government Gateway login on HMRC is the first step to simplifying how you’ll manage your business’s taxes. However once you’ve set up a Government Gateway you will also need to add each individual tax scheme that you wish to apply for.

These are referred to as ‘tax services’. In this article we will look at how to add PAYE.

It is important to note that for each tax service that you add to your Government Gateway account, you will receive an activation PIN in a letter through the post. This usually takes around 10 working days to arrive at your principal place of business.

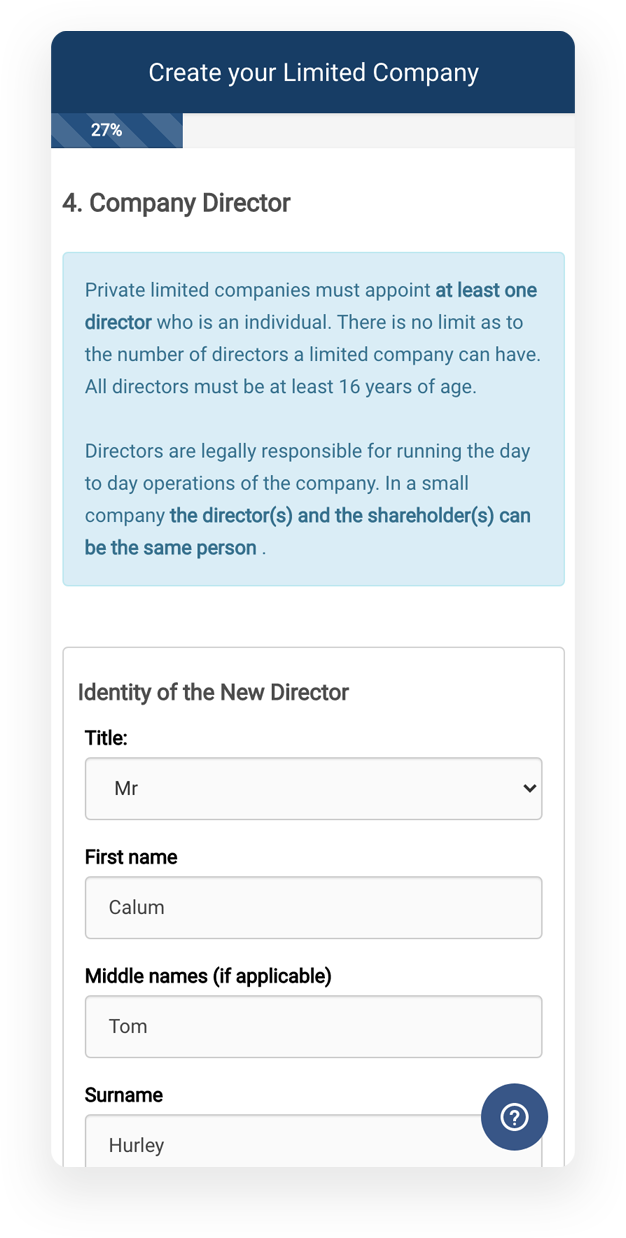

Adding PAYE taxes step-by-step

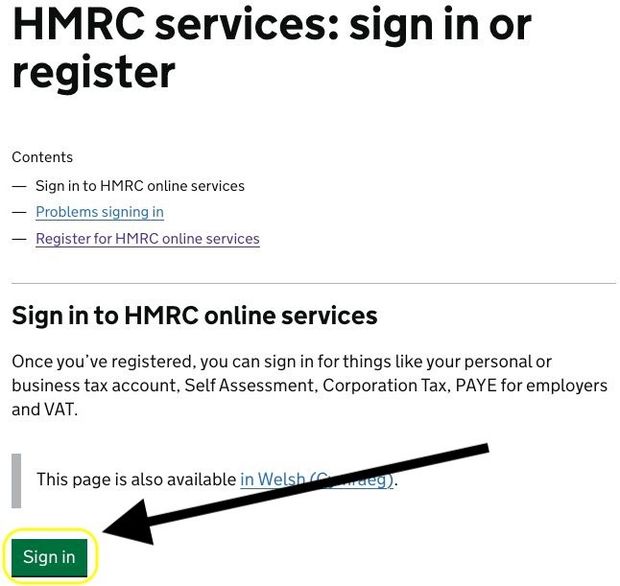

- Click here to log into your Government Gateway account. Click 'Sign In'.

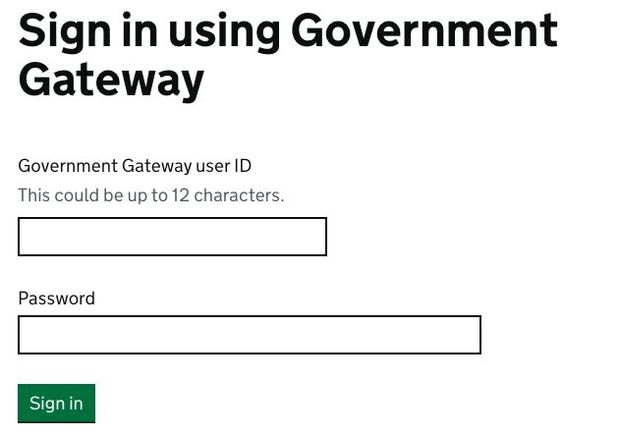

- Log into your organisation’s Government Gateway account:

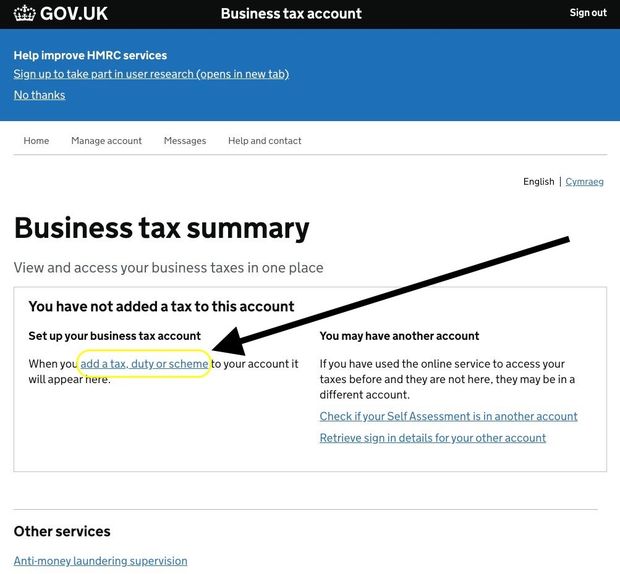

- Once you are logged in click on the 'add a tax, duty or scheme' button:

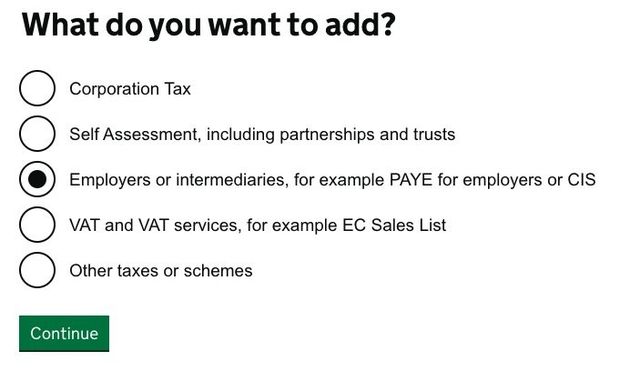

- For PAYE, choose 'Employers or intermediaries, for example PAYE for employers or CIS'

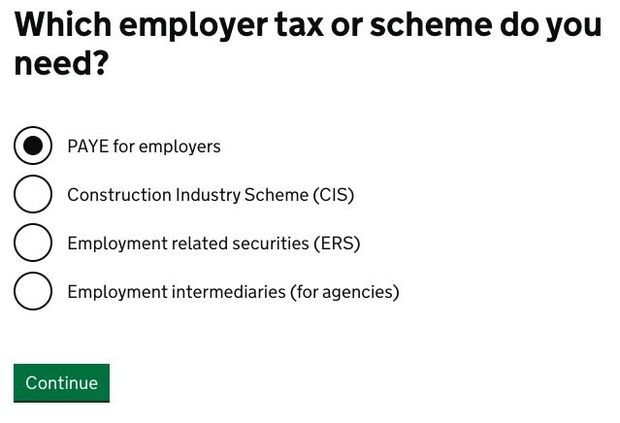

- Choose PAYE for employers on the next step:

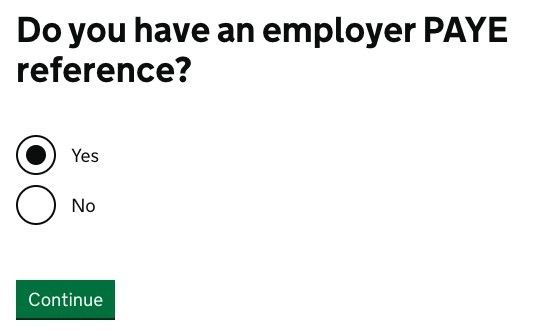

- Choose yes when asked if you have a PAYE reference (you would need to have received a letter through the post having registered for PAYE first):

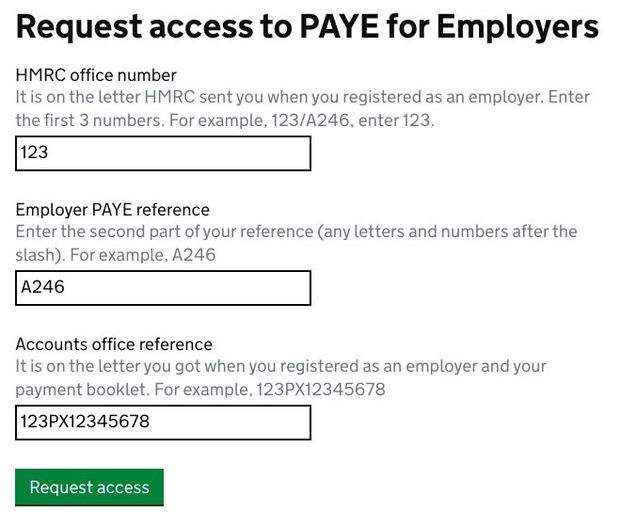

- On the next step you will need to enter your PAYE registration details, these are found on your PAYE registration letter. Your PAYE reference is divided by a forward slash, enter the 3 digits before the slash in the first box, then the rest into the box below. You can then enter the accounts office number in full in the final box:

- You will then receive a message stating that an ‘Activation PIN’ has been sent to your address. This letter takes 10 days to be received at your address, once you receive it, log back to your Government Gateway and enter the PIN. You will then receive confirmation that you have added PAYE taxes to your Government Gateway account.

By Daniel - 23/09/2021

By Daniel - 23/09/2021